In the high-octane, opaque world of High-Yield Investment Programs (HYIPs), there is a grim, mathematical certainty lurking behind every glossy interface: the collapse. Let’s strip away the marketing veneer and be brutally honest—the vast majority of these platforms are, at their core, sophisticated financial pyramids. They are not designed to last; they are designed to extract value, reach a saturation point, and then vanish. The only variable is time.

For the modern digital prospector, the game is not about finding a "legitimate" HYIP—those are statistical unicorns. The game is about risk management: getting in during the accumulation phase, securing profit, and exiting before the structural integrity of the scheme gives way. To survive this environment, you cannot think like an optimist. You must think like a forensic accountant.

These operations are masters of digital illusion. They construct elaborate backstories ("The Legend"), falsify audit reports, and sometimes hire actors to pose as CEOs in rented offices. They project an aura of inevitability. But beneath this polished surface, the mechanics are crude: liquidity from new investors is burned to pay the interest of the old. It is a fragile house of cards, and a single gust of wind—a sudden drop in crypto prices or a panic-induced withdrawal wave—can bring the ceiling down. This dossier is your field guide to spotting the rot before the floor gives way.

Investigative Analysis by: Matti Korhonen, independent financial researcher from Helsinki. Specializing in high-risk investment monitoring, blockchain forensics, and cryptocurrency fraud analysis since 2012.

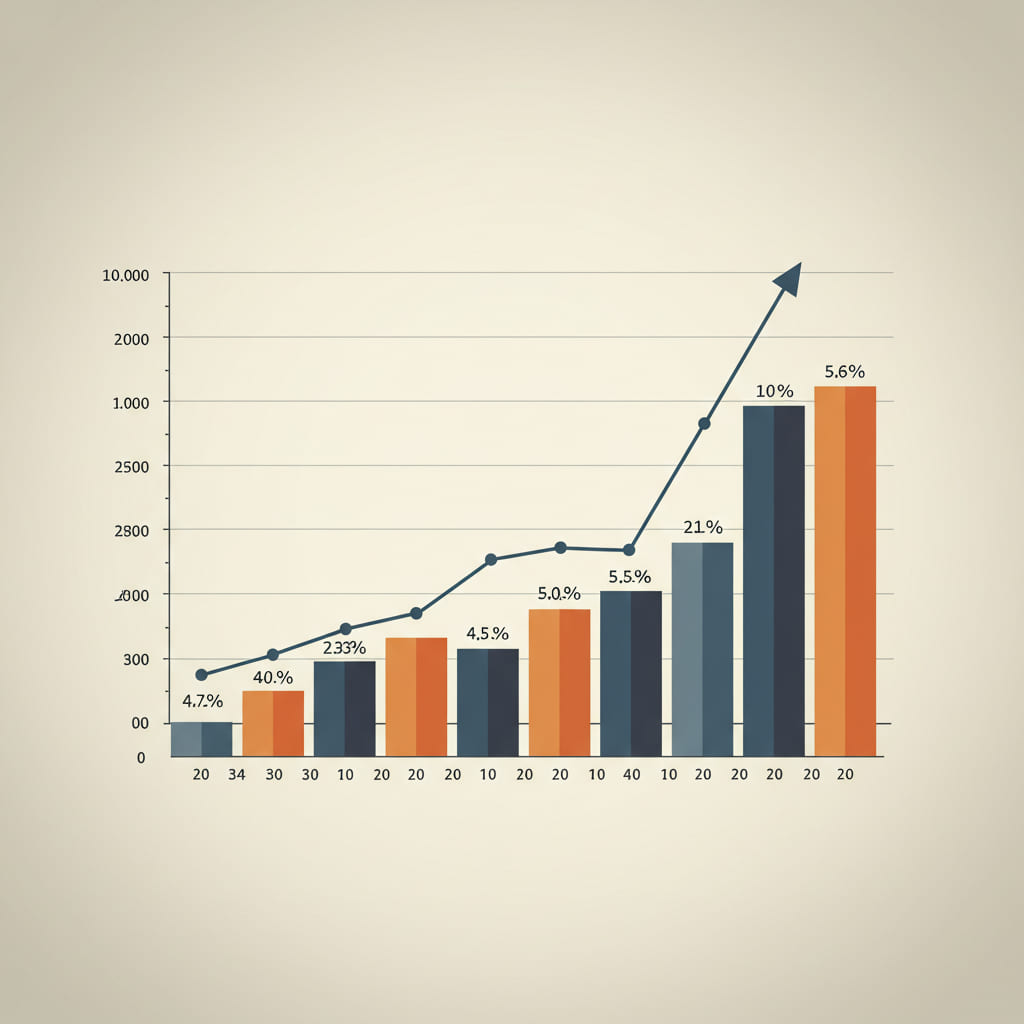

A HYIP collapse is rarely a sudden, random event. It is usually the culmination of a weeks-long deterioration in liquidity. There are always tremors before the earthquake; the problem is that most investors are too intoxicated by their daily returns to feel them. Your job is to remain sober and watch for the specific patterns that signal an admin is packing their bags.

The most reliable sign of a dying Ponzi is a sudden, desperate need for fresh cash. When the inflow of new deposits no longer covers the outflow of withdrawals, the admin faces a liquidity crisis. Their solution? The "Too Good to Be True" promotion.

When an admin decides to pull the rug, they rarely just shut the server off immediately. They buy time to drain the wallets while keeping investors hopeful. They do this by fabricating technical issues.

This is perhaps the most insidious tactic. To keep the scam running for a few extra days, admins will stop paying regular investors but continue paying high-profile monitors and influencers.

To understand when a collapse is coming, you have to look at the story they are selling. If a project cannot clearly and believably explain how it generates yield, it isn't generating any.

Expert Insight: "I call it the 'Magic Box' theory. If they claim to have a proprietary AI trading bot that never loses, ask yourself: Why do they need your $50? If they had a money printer, they would guard it with their lives, not rent it out to strangers on the internet. The opacity is not a security feature; it is the fraud itself."

Red Flags in the Narrative:

Understanding the technical red flags is only half the battle. The other half is battling your own brain. Scammers are not just thieves; they are amateur psychologists. They exploit two powerful cognitive biases: Greed and Confirmation Bias.

The Dopamine Loop

When you receive that daily notification—"You have received funds"—your brain releases dopamine. You feel smart. You feel validated. When red flags start to appear (e.g., a delayed payment), your brain tries to protect that feeling. You rationalize. "It's just a weekend delay," you tell yourself. "The admin is active in the chat, he seems nice."

The Social Proof Trap

Scammers use "shills"—fake accounts or paid promoters—to flood Telegram groups with positivity. When you see 50 people cheering, it is hard to be the one person asking tough questions. This manufactured consensus is designed to isolate skeptics and keep the money flowing until the very last second.

Consider a hypothetical project, "CryptoFlux." For 40 days, it pays 1% daily. It’s stable. Suddenly, on Day 41, they launch a "VIP Plan": Deposit $5,000 and get 500% in 5 days.

Novice investors see this as a golden opportunity. Veteran analysts see it as a death rattle. The admin knows the intake is slowing down. They need one big score before they burn the server. The "VIP Plan" is the trapdoor opening.

To avoid HYIP fraud and minimize losses, you must treat every single program as a potential scam from the moment you see the URL. Your default position should be disbelief, not trust. Trust is a vulnerability.

The difference between a victim and a survivor in the HYIP space often comes down to the ability to leave the party while the music is still playing. The collapse is inevitable. It is written into the code of the Ponzi structure.

By monitoring the liquidity, ignoring the emotional manipulation, and recognizing the "final cash grab" signals, you can navigate this treacherous landscape. Remember: In the digital wild west, the admin is not your partner. They are your opponent. Play accordingly.