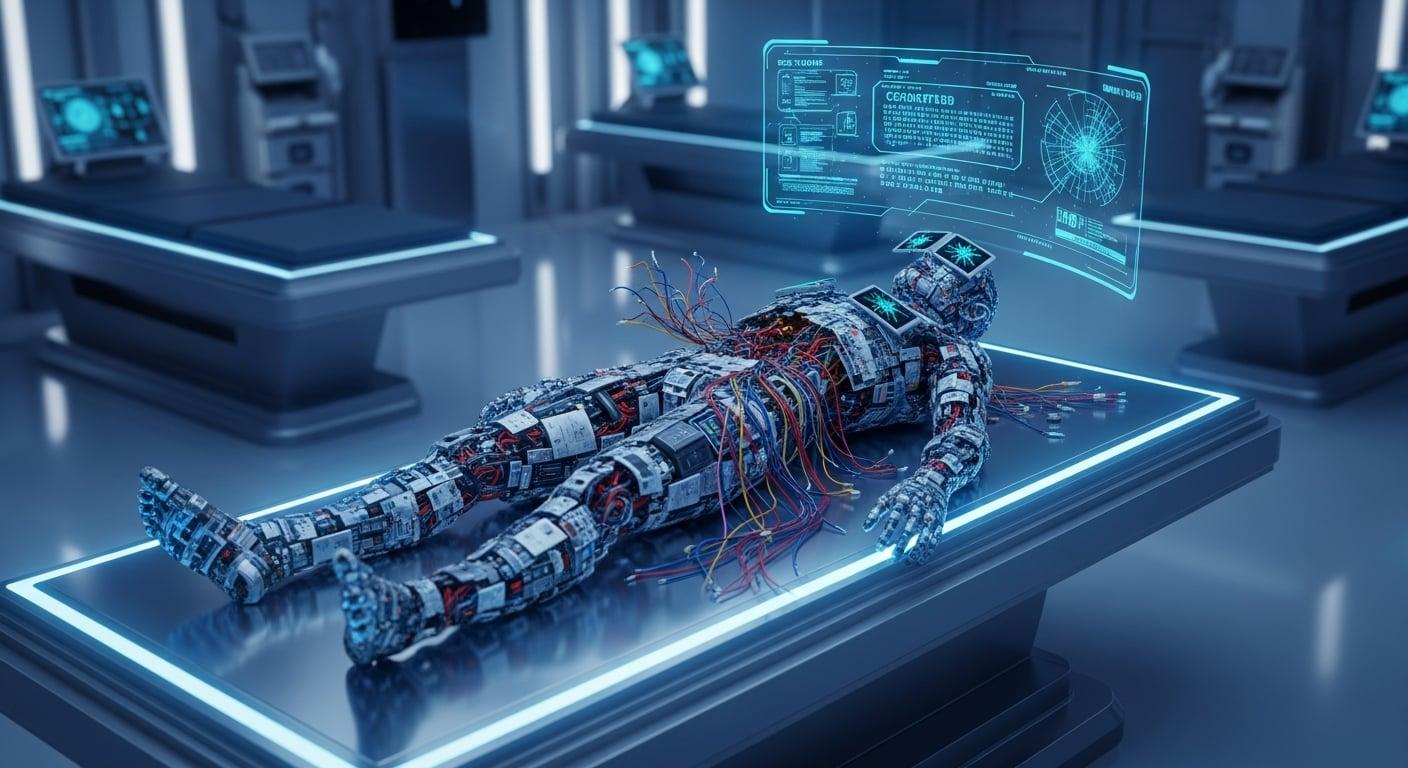

Let’s be brutally honest. Stepping into the arena of new High-Yield Investment Programs is like walking into a surgeon’s operating theater in the middle of a city-wide blackout, with a blindfold on, and handing the scalpel to a man in a clown mask. The odds are not in your favor. Every day, the internet births a fresh litter of these projects, and the vast majority are dead on arrival—digital time bombs with a fuse so short you can smell the gunpowder. To navigate this charnel house requires you to stop thinking like an investor and start thinking like a forensic examiner. Your job is not to find a healthy, living creature; it's to perform a rapid digital autopsy on these newborn entities to determine if they were built with the professional craftsmanship of a 'long-game' con artist or the sloppy, desperate haste of a common digital mugger. This is not a guide to finding 'safe' HYIPs—a concept as mythical as a sober unicorn. This is a protocol, a rigid, systematic dissection that allows you to identify the tell-tale signs of quality within the fraud, potentially granting you the sliver of an edge needed to survive the first 24 hours.

The core philosophy of this protocol is to assess the admin's investment—not their fictional investment in 'forex', but their real, tangible investment in the infrastructure of their scam. A cheap, lazy admin will build a cheap, lazy scam that is destined to collapse the moment it encounters the slightest financial pressure. A professional, well-funded admin, however, understands that to build a truly massive Ponzi, one that can attract millions, they must first spend tens of thousands on the stagecraft. They invest in custom scripts, robust security, and a compelling narrative. It is by analyzing the quality of this stagecraft, this initial investment of resources, that we can make an educated guess about the admin's intentions and the project's potential, albeit brief, lifespan. This is a game of reading the ghost in the machine, and it begins with a cold, hard look at the technical bones of the operation.

Author: Jessica Morgan, U.S.-based fintech analyst and former SEC compliance consultant. She writes extensively about digital finance regulation and HYIP risk management.

Before you ever read a single word about their investment plans, you must scrutinize the vessel. A professional operation will not be housed in a digital shack. This initial triage is a pass/fail test; a failure on any of these points should lead to an instant disqualification.

“An admin’s choice of hosting is their first confession. Shared hosting, which costs less than a cup of coffee per month, is a signed statement of their intent to commit a petty crime. A dedicated server with high-end DDoS mitigation is a statement of their intent to commit a felony. As an analyst, you are far more interested in the felon; they have a business plan.” - A cybersecurity contractor specializing in high-risk financial platforms.

Your rapid technical checklist includes:

If the project has passed the initial technical triage, it's time to dissect the scam's actual blueprint: its financial model and its story. This is where you analyze the trap itself, not just the box it came in.

The plans are the mathematical soul of the scam. They reveal the admin's intended timeline and target audience. Avoid the obvious traps like hourly plans or absurdly high daily returns. Instead, focus on the structure.

| Plan Structure | Example | Analytical Insight |

|---|---|---|

| 'Principal Included' (After Plans) | 15% daily for 8 days (Total Return: 120%) | Your actual profit is only 20%. Your break-even point is on Day 7. These plans are riskier than they appear as your capital is locked for the entire term. They are often used by fast scams. |

| 'Principal Return' (Daily Plans) | 3% daily for 20 days, principal back at the end. | Your profit is 60%, but you only break even if the program survives the full 20 days to return your principal. It's a massive risk on the program's longevity, favored by 'Long Game' admins who want to hold onto capital. |

| The 'Perfect' Hybrid | 4% daily for 30 days, principal included. | This is a common structure for 'Long Game' HYIPs. The daily return is enticing. Your break-even point is at 25 days. The admin is betting most investors will get greedy and compound, never reaching that break-even point before the project's planned 30-45 day lifespan is over. |

The backstory is always fiction, but the quality of the fiction matters. A professional admin hires a good writer. Look for:

By conducting this rigorous, multi-layered autopsy before you even consider making a 'scout' deposit, you shift the odds ever so slightly. You are no longer a blind gambler walking into a dark room. You are an examiner with a checklist and a powerful flashlight, fully aware that the room is full of traps, but now equipped with the tools to see them. In the brutal world of new HYIPs, this clarity is the only armor you will ever have.