Voices from the Abyss: The Art of Decoding User Comments on HYIP Monitors

Beneath the clean, structured data of a HYIP monitor—the status, the uptime, the investment plans—lies a far more chaotic and far more human layer of information: the user comment section. This is the digital abyss, the public square where investors from every corner of the globe gather to share their experiences. It is a torrent of hope, greed, anger, and deception. To the untrained eye, it is an incomprehensible mess, a stream of broken English, payment proofs, and referral links. Most people ignore it entirely. But to a skilled analyst, this abyss is a goldmine of qualitative data. It is where the true sentiment of the community can be gauged, provided you know how to listen.

The problem is that the comment section is a battlefield in an information war. It is actively manipulated by every actor in the ecosystem. HYIP admins use it to build hype. Promoters use it to find referrals. Disgruntled investors use it to vent their frustration. Learning to read these comments is not like reading a book; it's like being a detective at a crime scene with too many witnesses, most of whom are lying. You must learn to assess the credibility of the source, understand their motivation, and look for the subtle patterns that betray the truth.

This is a guide to that difficult art. It's about how to tune out the noise of the shills and the ranters to hear the few, authentic voices from the abyss.

The Three Archetypes of Commenter

To begin, you must understand that nearly every comment is posted by one of three archetypes. Identifying the author's archetype is the first step in assessing their message.

- The Shill (The Marketer): This user's goal is to promote the program. They are either the admin themselves, a paid promoter, or an investor who is heavily incentivized by the referral system. Their comments are uniformly positive, often with an almost robotic enthusiasm.

How to spot them: Their posts often include their referral link. They post multiple times a day. Their language is generic and hype-filled (e.g., "Best program ever! Admin is genius! To the moon!"). They will often attack anyone who posts a negative comment, accusing them of being a 'hater' or a 'competitor.'

- The Newbie (The True Believer): This is a new investor, often in their first or second program. They are genuinely excited. They just received their first small payout and are eager to share their success. Their positivity is authentic, but also naive.

How to spot them: Their language is sincere but often inexperienced. They might ask basic questions. They post screenshots of very small withdrawal amounts. While their experience is real, it has very little predictive power about the program's long-term health.

- The Veteran / The Scammed (The Realist): This user is experienced. They have been in the industry for a while and have likely been burned before. They are either posting a factual, unemotional report of a payment, or they are posting the first warnings of a problem. When a program starts to fail, these are the first authentic negative voices to appear.

How to spot them: Their posts are factual and specific. A positive post might be, "Received $15.20 via USDT TRC20. Batch ID: [xxxx]." A negative post will be equally specific: "Withdrawal of $100 via BTC pending for 16 hours. Stated time is 6 hours. Admin is not responding." These are the comments to pay attention to.

A Strategic Guide to Reading Comments

With these archetypes in mind, you can apply a strategic filter to the comment section.

- Ignore 90% of the Positive Comments: The overwhelming majority of positive posts are from shills and excited newbies. They are noise. They confirm only that the withdrawal button worked for a small amount, at one point in time. This is low-grade information.

- Search for Specificity in the Negative Comments: A generic post like "This is a scam!" is not very useful. But a post that says, "Admin is no longer processing withdrawals over $200" is a highly specific and actionable piece of information. This is a potential signal of selective payout problems, a classic sign of an impending collapse.

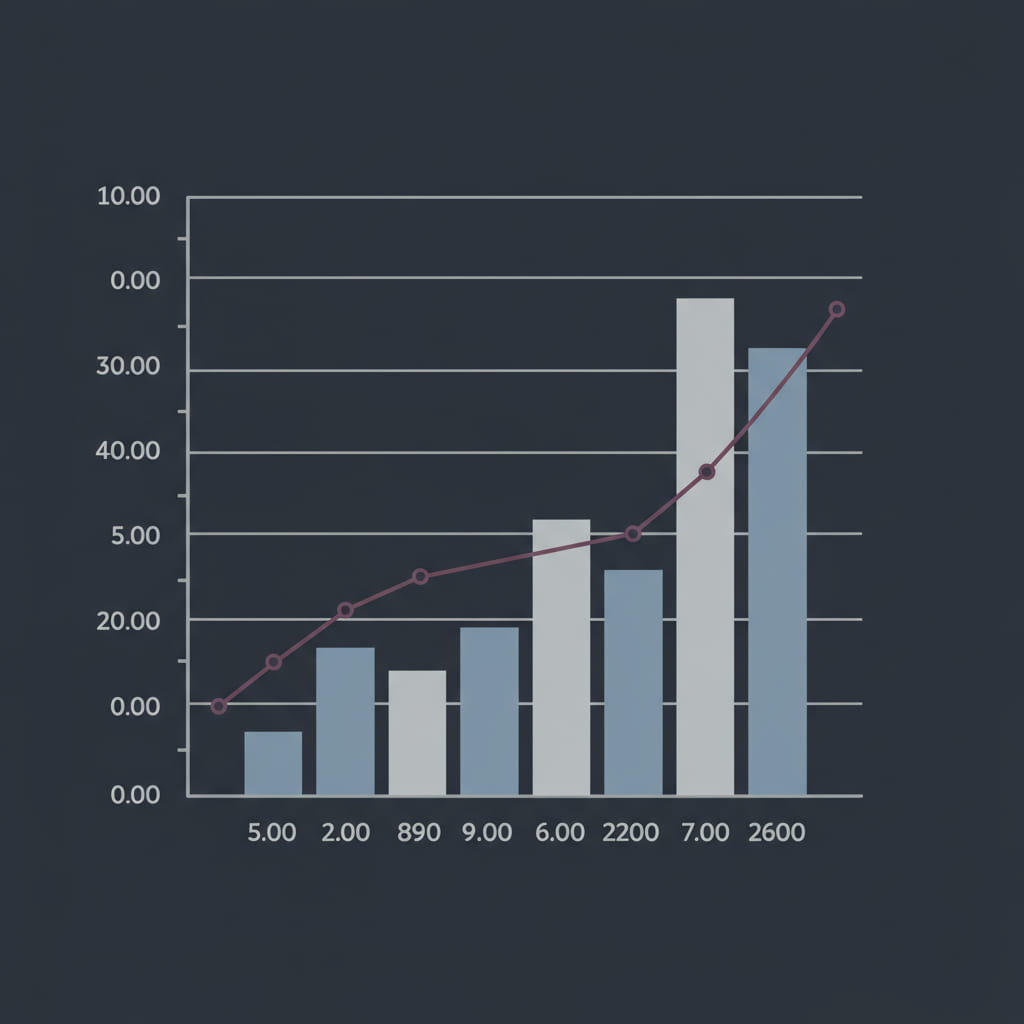

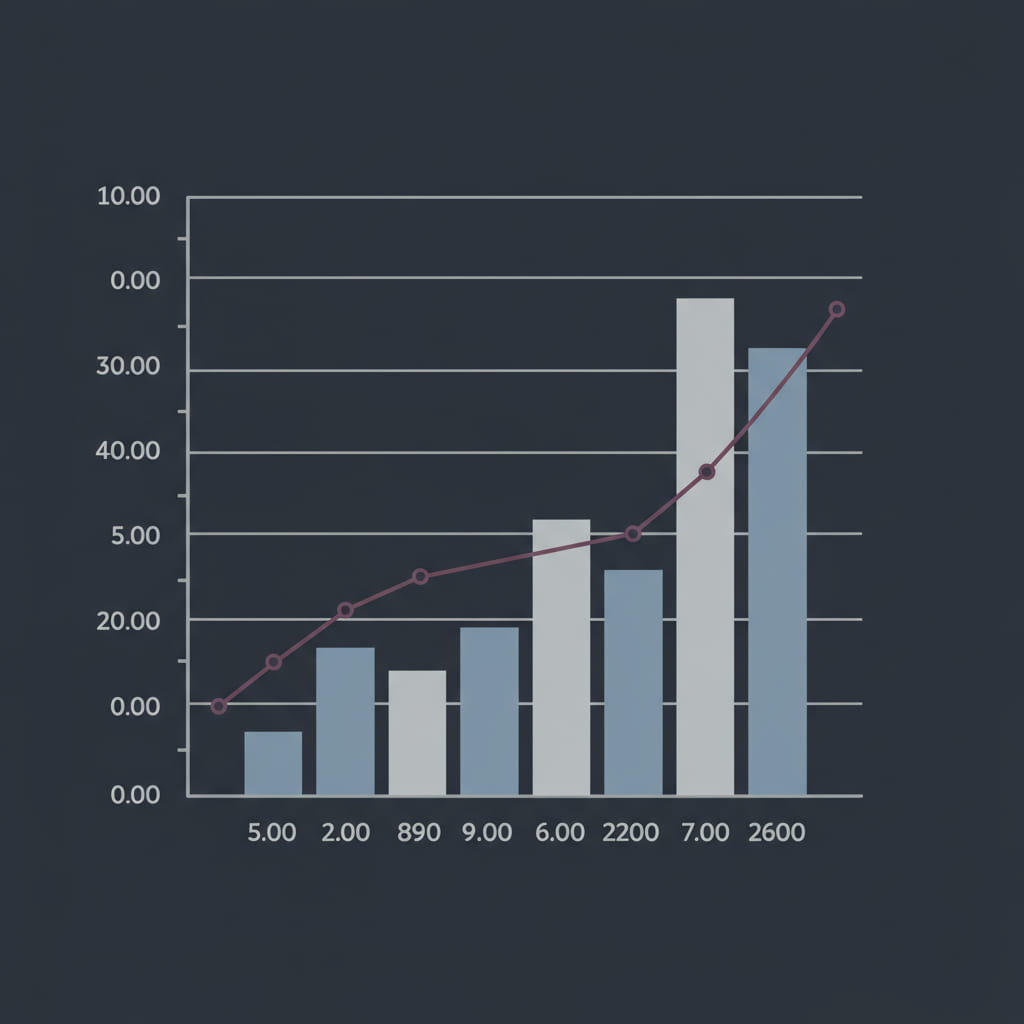

- Look for a Shift in the Ratio: In a healthy, new program, the comment section might be 95% positive. As the program ages and begins to fail, that ratio will start to shift. When you see the number of specific, credible negative comments begin to rise, even if they are still outnumbered by the shills, that is a powerful leading indicator of trouble. The trend is more important than the absolute numbers.

- Cross-Reference with Forums: The comment sections on monitors are short-form. For more detailed discussions and analysis, you need to cross-reference the sentiment with the discussions happening in the wider HYIP community on forums.

The Moral Dimension

There's a fascinating ethical aspect to the comment section. It's a microcosm of the difficult questions surrounding the moral compass of HYIPs. The shill, who is actively luring new people into a failing program to earn a commission, is arguably as culpable as the admin. The veteran who posts the first clear warning is, in their own small way, acting as a genuine watchdog.

Conclusion: Learning the Language of the Abyss

The user comment section of a HYIP monitor is a messy, chaotic, and often deceptive place. But it is not meaningless. For the analyst who is willing to do the work—to learn the archetypes, to filter the noise, and to search for the specific, credible signals—it is one of the most valuable sources of real-time, qualitative data available. It's the closest you can get to taking the pulse of the investor community. Learning to read it is learning the true, unspoken language of the HYIP industry.

Author: Jessica Morgan, U.S.-based fintech analyst and former SEC compliance consultant. She writes extensively about digital finance regulation and HYIP risk management.