In the chaotic, unregulated world of digital finance, the amateur investor is always hunting for a "Unicorn"—that one perfect program that will run forever and make them rich. The pro knows better. In the High-Yield Investment Program (HYIP) space, every single project is mathematically doomed to hit zero eventually. It's not about *if* a program collapses, it's about *when*.

To survive here, you have to stop thinking like a gambler picking a horse and start thinking like an architect building a skyscraper in an earthquake zone. You assume things will break. Your goal is to build a portfolio so resilient that when one piece crumbles, the whole structure doesn't come down with it. This is what I call Portfolio Engineering.

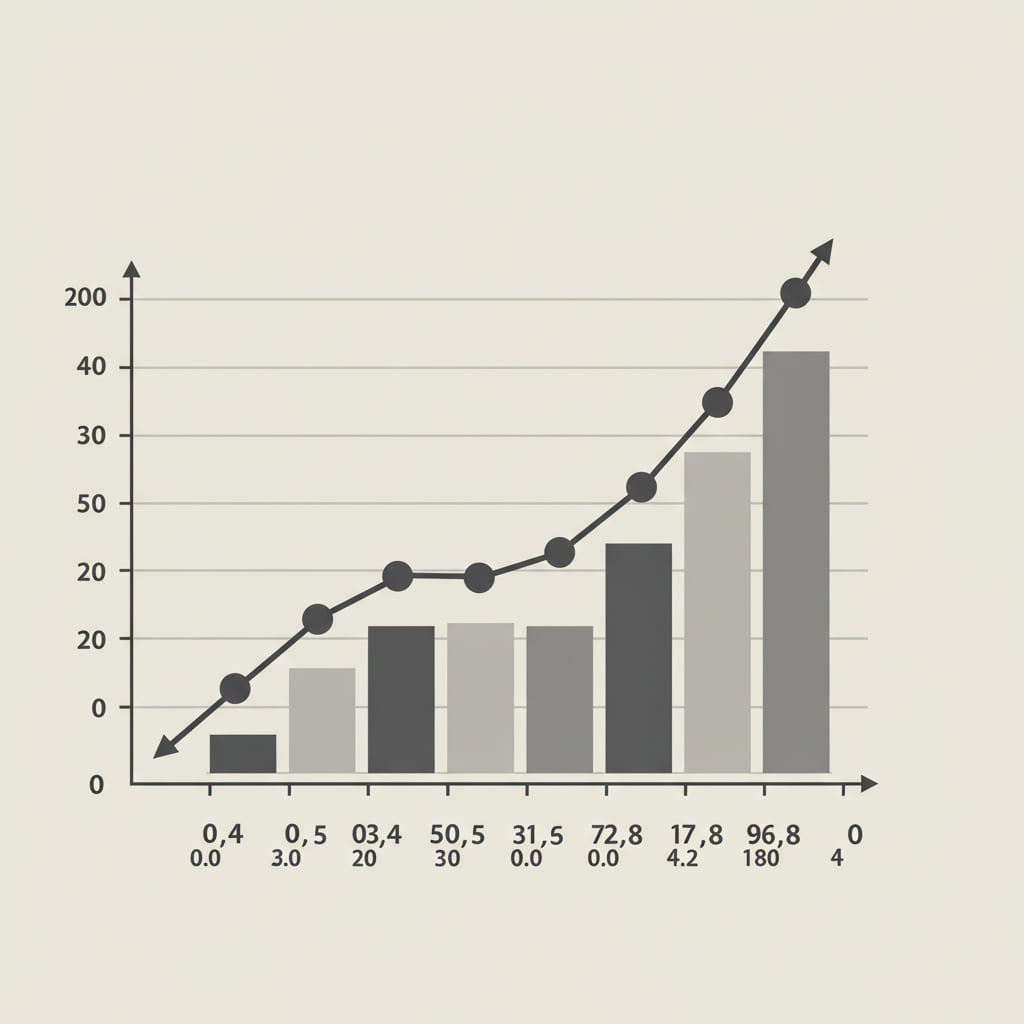

The *HYIP rating* lists we pore over aren't just shopping lists; they're the raw materials for your blueprint. By reading this data the right way, you can mix and match assets—combining steady ones with wild ones—to create a system that stays profitable even as individual bets blow up. This is your framework for building something that lasts.

Strategic Analysis by: Edward Langley, Investment Strategist. Specializing in asymmetric risk assessment, digital asset tracing, and the forensics of the online shadow economy.

The biggest mistake most people make is "Uniform Allocation"—throwing equal amounts of money at random programs on a monitor. That's a fast track to zero. Instead, you need a strategy that splits your capital into two distinct parts, each with a different job.

Allocation: 60% – 70% of your total capital.

The Job: Steady cash flow and capital preservation.

The Core is your "Tortoises" (check out our guide on Long-Term vs. Short-Term Ratings). These are the slower, steadier programs designed to last. They usually pay 0.5% to 2% daily. The point here isn't to get rich quick; it's to create a reliable stream of money that you can either pull out as income or use to fund your riskier plays.

Allocation: 30% – 40% of your total capital.

The Job: Growth and high-stakes speculation.

The Satellites are your "Hares." These are the high-flying, short-term programs (think 4% daily or "150% After 1 Day" plans). They're volatile, and you should expect some to fail. But the logic is that one big win in a Satellite (like doubling your money) will easily cover the losses from two or three that flop. This gives you Asymmetric Upside—the potential rewards are much bigger than the risks you're taking on that portion of your money.

You can't use the same checklist to pick a Core program and a Satellite program. You have to approach the *HYIP rating* lists with different eyes for each.

When you're choosing the foundation of your portfolio, you're looking for durability. You want programs that have already weathered the storm of launch.

For the speculative part of your portfolio, you're looking for speed and momentum. You're playing the "Sniper" game here.

Building the portfolio is only half the battle. Managing it actively is where you make (or save) your money. You need strict rules for handling the cash flow.

A portfolio is a living thing. If one of your Satellite bets hits and doubles, your portfolio is suddenly riskier than you planned—you've got too much money in the volatile zone.

The Strategy: Systematically take profits from your winning Satellites and move them to:

A) Your external cold wallet (this is realized, safe profit).

B) New deposits in your steady Core programs (this reinforces your foundation).

Never let profits just sit in a high-risk program. Money left in the system isn't profit yet; it's just risk that hasn't been cashed out.

Real diversification isn't just having ten different programs; it's making sure those ten programs aren't all run by the same person or group.

The Danger: "Serial Admins" often launch several scam sites at once. If you invest in three sites that look different but share the same server or wallet addresses, you're not diversified at all—you're just multiplying your risk with one operator.

The Defense: Use advanced monitor data to check hosting providers and wallet clusters. Avoid putting money into programs that look like they came from the same factory.

Your number one goal for every single investment is to hit the Break-Even Point (BEP).

The Rule: Until you have pulled out 100% of the original money you put into a specific program, you do NOT compound or reinvest. You withdraw your earnings daily. Once you hit BEP, that particular investment becomes "house money." *Then* you can think about being more aggressive. This turns each position from a liability into a pure asset.

Expert Insight — Edward Langley: "Building a portfolio here is all about active risk management. You're accepting that some picks will fail. The system works if the steady income from your Core, plus the occasional big win from a Satellite, consistently adds up to more than you lose from the scams. It's a game of averages, not magic. If you rely on luck, you'll lose eventually. If you rely on math and structure, you've got a shot."

The leap from novice to professional happens when you realize you can't *predict* the future, but you can absolutely *prepare* for it. You'll never know for sure which program scams tomorrow. But you can build something that will withstand it when it happens.

By using *HYIP rating* lists to find the right pieces—carefully separating the steady Tortoises from the fast Hares—and sticking to a disciplined Core-Satellite strategy, you build a buffer against the chaos. You stop trying to outsmart every single admin and start trying to beat the overall averages. In this digital wild west, the architect is the one who's still standing long after the gamblers have blown their stacks.