In the unregulated, high-entropy ecosystem of High-Yield Investment Programs (HYIPs), not all algorithms are created equal. To the untrained eye, the market appears as a monolithic wall of risk—a chaotic casino where every click is a gamble. But to the seasoned forensic analyst, the landscape is nuanced. It is a spectrum of volatility defined by a simple, ruthless trade-off: Time vs. Yield.

We call this the "Tortoise and Hare" dynamic. On one end of the spectrum, you have the "Hares"—fast-burning, high-velocity programs designed to explode with activity and vanish within days. On the other, the "Tortoises"—slow, methodical engines of accumulation that aim to survive for months or years. A successful investor does not simply pick the program with the highest *HYIP rating*; they act as a portfolio architect, understanding that these two categories require fundamentally different psychological approaches, risk management protocols, and exit strategies.

This dossier serves as your strategic manual. We will strip away the marketing veneer and dissect the mechanics of both types. We will explore why a "Top 10" rating means something entirely different for a sprinter than it does for a marathon runner, and how to align your capital with the physics of the market.

Investigative Analysis by: Jessica Morgan, Fintech Analyst & Risk Specialist. Former SEC compliance consultant writing extensively on digital finance regulation and the mechanics of the shadow economy.

These are the programs that dominate the "New Listings" feeds. They are the adrenaline shots of the industry. They are built for one thing: Velocity.

A "Hare" program is characterized by aggressive mathematics.

— The Promise: "10% Daily," "20% Daily," or the notorious "After" plans (e.g., "150% After 1 Day").

— The Lifespan: These models are mathematically insolvent from the moment of inception. They rely on a massive, immediate influx of cash to pay the first round of investors. Their lifespan is measured in hours or days, rarely weeks.

— The Technicals: Often built on cheaper, template-based scripts. The admin knows the site will be dead in 72 hours, so they minimize their overhead costs.

Investing in a short-term *hyip program* is not investing; it is high-frequency arbitrage against the inevitable collapse. It requires the mindset of a day trader.

1. The "Day Zero" Rule: Timing is the only variable that matters. If you enter a "20% Daily" program on Day 4, you are statistically the liquidity that pays the Day 1 investors. You must enter within the first 6 hours of launch.

2. The Hit-and-Run: You do not compound. You do not reinvest. You deposit once, complete one cycle (e.g., 24 hours), withdraw your capital + profit, and never look back.

3. The Monitor Watch: You must watch the *HYIP monitor* incessantly. If the status flickers to "Waiting" for even 10 minutes, the game is over.

Analyst Note: "The 'Hare' is a game of musical chairs played at 100mph. The music stops quickly. If you are holding the bag when the admin pulls the plug, no amount of technical analysis will save you. This is pure PVP (Player vs. Player) finance."

On the other side of the divide lie the "Tortoises." These are the programs that aim to become "Legends"—the pillars of the community that run for 200, 300, or 500 days.

A long-term program is designed to mimic a legitimate financial institution.

— The Promise: Modest, sustainable returns. Usually 0.5% to 2.5% daily, often only on business days.

— The Infrastructure: These admins invest heavily. Custom scripts, dedicated servers, EV SSL certificates, and elaborate "Legends" (backstories about AI trading, oil drilling, etc.). They are building a brand.

— The Psychology: They rely on trust. They pay flawlessly for months to build a massive user base before the eventual exit.

With a long-term program, your enemy is not speed; it is Complacency.

1. Deep Due Diligence: Unlike the Hare, where you jump in blind, the Tortoise requires research. You want to see a flawless payment record stretching back 30-40 days. You want to see steady, organic growth on the monitors, not a sudden spike in advertising.

2. The Race to Break-Even (BEP): Your goal is to recover your seed money. If a program pays 1% daily, it takes 100 days to reach BEP. This is a long exposure window.

3. The "House Money" Phase: Once you have withdrawn 100% of your principal, you enter the "Risk-Free Zone." This is the holy grail of HYIP investing. You continue to withdraw pure profit for as long as the admin keeps the lights on.

Here is where novice investors get slaughtered: they treat all ratings as equal.

A *HYIP rating* is contextual. You cannot judge a Sprinter by Marathon metrics.

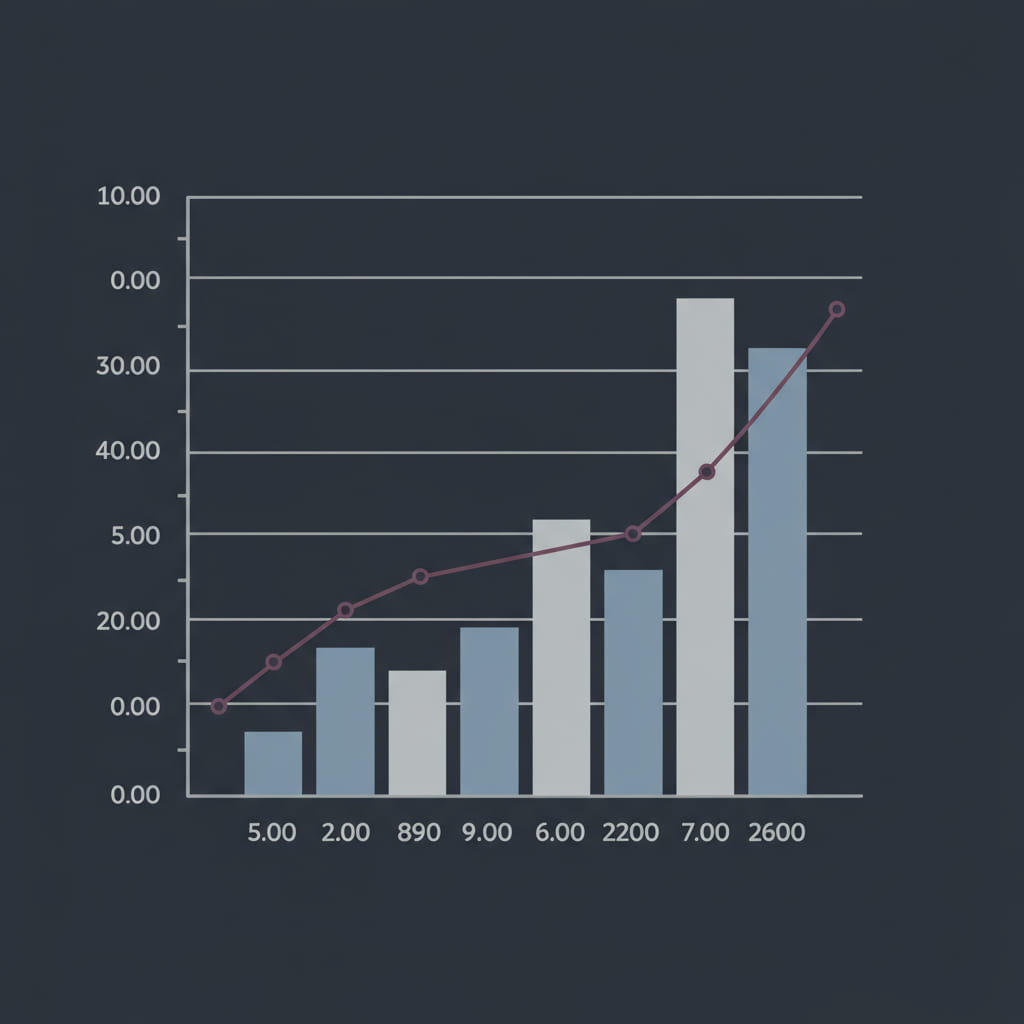

So, how does the sophisticated investor allocate capital? You do not choose one side; you engineer a system that utilizes both. In institutional finance, this is known as the "Barbell Strategy"—pairing extreme safety with extreme risk, avoiding the mediocre middle.

The Core (The Tortoise Shell): 70% Allocation

The bulk of your capital goes into 2-3 high-quality, long-term programs.

— Goal: Consistent daily cash flow. These programs pay the "bills" and keep the portfolio green.

— Risk Profile: Moderate. You accept that it takes months to break even.

The Satellite (The Hare's Sprint): 30% Allocation

The remaining capital is used for high-velocity "sniping."

— Goal: Alpha generation. You use small amounts to hit short-term programs on Day 1.

— Risk Profile: Extreme. You expect to lose on some, but one successful "150% in 3 Days" hit can cover the losses of three failed attempts.

Expert Insight — Jessica Morgan: "A balanced portfolio acts as a shock absorber. The long-term programs provide the floor—a relatively stable base of returns that keeps you in the game. The short-term plays provide the ceiling—the explosive potential to double your stack in a week. If you only bet on Hares, you will eventually burn out. If you only bet on Tortoises, you succumb to opportunity cost. You need both engines running."

Finally, you must assess your own temperament. This is the "Sleep Test."

— The Adrenaline Junkie: If you enjoy checking your phone every 15 minutes, refreshing the page, and tracking hourly accruals, the Short-Term market is your arena.

— The Strategist: If you prefer to set up a system, check it once a day over coffee, and focus on long-term trends, stick to the Low-Yield sector.

Investing against your personality type is the fastest way to make emotional mistakes. As we discussed in our guide to portfolio construction, knowing yourself is just as important as knowing the market.

Whether you choose the path of the Tortoise or the Hare, remember that both are running a race against time. The Short-Term program is sprinting toward a cliff; the Long-Term program is walking toward it. The cliff is inevitable for both.

By understanding the mechanics of velocity, conducting appropriate due diligence for the specific program type, and interpreting *HYIP monitor* data with the correct context, you transform from a gambler into a tactician. You stop asking "Is this legit?" and start asking "Does this fit my timeframe?" In the digital wild west, timing is everything.