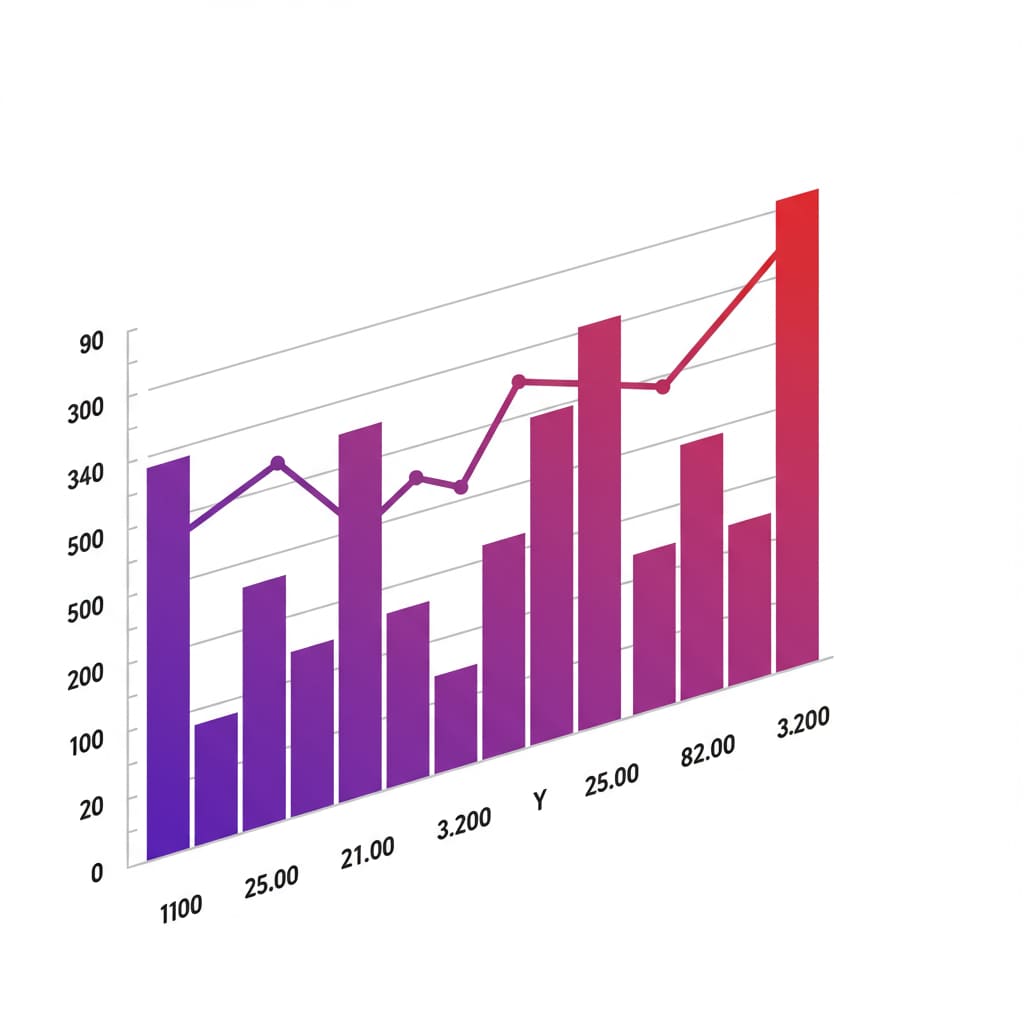

In the chaotic, unregulated ecosystem of High-Yield Investment Programs (HYIPs), there is one immutable law that supersedes all marketing claims and "proprietary trading" legends: The Law of Gravity. Every program, no matter how professionally designed, how massively capitalized, or how seemingly invincible, follows a specific, predictable biological lifecycle. It traces a dramatic parabolic arc—rising from obscurity, accelerating into explosive growth, plateauing at a point of maximum saturation, and finally, collapsing into the void.

The top-rated programs—the "Legends" that dominate the banner ads and forum signatures for months—do not defy this lifecycle. They simply elongate it. The administrators running these elite projects are not just scammers; they are master logisticians. They manage the inflow and outflow of capital with the precision of a central bank, manipulating confidence to extend the game for as long as the mathematics allow.

For the strategic investor, understanding this lifecycle is akin to possessing a topographic map of the battlefield. It allows you to triangulate exactly where a project sits on the curve. Are you looking at a rising star where the risk-to-reward ratio is favorable? Or are you looking at a bloated giant teetering on the edge of a liquidity crisis? To survive this market, you must learn to ignore the hype and watch the clock. Let’s deconstruct the anatomy of the arc.

Investigative Analysis by: Jessica Morgan, Fintech Analyst & Risk Specialist. Former SEC compliance consultant writing extensively on digital finance regulation and the mechanics of the shadow economy.

Timeline: Days 1–20 (Variable based on plan structure)

Contrary to popular belief, the most successful HYIP programs rarely launch with a bang. They emerge from the digital ether quietly, almost reluctantly. This is the "Stealth Phase," and it is a calculated strategic move by the administrator.

The goal here is not to attract the masses—yet. The goal is to build a verifiable history of solvency. The admin needs data points. They need to populate the "Last Payouts" widget with real transaction hashes. They need a calendar marked with green "Paid" checks.

The Investor’s Perspective: This is the "Venture Capital" stage. The risk is high because the project is unproven, but the potential reward is maximum because you are entering at the bottom of the pyramid. You are betting on the admin’s ambition.

Timeline: Days 21–60

If the project survives the incubation phase without technical failures, the admin shifts gears. This is the "Growth Phase," where the marketing budget is unlocked. The silence is replaced by a roar.

The admin begins buying "Premium" listings on top-tier HYIP monitor sites. They purchase banner ads on major forums like TalkGold and MMGP. The "test" investors from Phase 1 verify that the system works, and their positive reports act as the catalyst for social proof.

The Investor’s Perspective: This is the momentum trade. The project has a track record, but it hasn't yet reached saturation. Smart money enters here and sets a strict exit target. This is the phase strategic tools, like those discussed in our guide on long-term vs. short-term ratings, are designed to identify.

Timeline: Days 61–90+ (The Danger Zone)

The program is now a Titan. It sits at the #1 spot on every HYIP rating list. The admin is a celebrity in the Telegram chat. New members are joining by the thousands. The "Legend"—whether it is AI Trading or Oil Futures—is accepted as fact by the naive.

But this is the point of maximum danger.

In a Ponzi structure, obligations (interest payments) grow exponentially, while the pool of potential new investors is finite. Eventually, the lines cross. The daily payout obligation begins to rival the daily deposit intake. The project hits "Saturation."

Timeline: The End Game

The collapse is rarely an accident. It is a premeditated execution. When the admin’s internal metrics show that the inflow of new money has dropped below the outflow of payments, they trigger the Exit Protocol.

They have one goal left: Maximize the final harvest.

Expert Insight — Jessica Morgan: "The collapse is written into the DNA of the model. A top-tier admin is essentially a logistics manager for a ticking time bomb. Their skill lies in maximizing the duration of the growth phase and managing the peak. But they cannot defy the underlying mathematics of a Ponzi structure forever. When the math turns negative, the morality—if there ever was any—evaporates instantly."

The parabolic arc is ruthless, but it is navigable. The key is to detach your emotions from the timeline.

By learning to overlay this lifecycle map onto any project you analyze, you transform from a gambler hoping for luck into a tactician operating within a defined window of opportunity. The arc always bends toward zero; your job is to get off before the drop.